Happy Thanksgiving to everyone!

While some folks may binge on the turkey eating during the Thanksgiving, big technology firms commonly known as ‘Big Techs’ certainly are binging on the capital expenditure (capex) spendings front primarily centered around artificial intelligence (AI) investments.

Oracle (ORCL) stock is down by about a third from the all-time peak it set on the frenzied day of September 10 due to cloud deal with OpenAI and our write-up the following day as shown here: “Much Coveted Crown of The Wealthiest Person in the World & Hot Air Balloon Transfer – From Musk to Ellison”.

Larry Ellison, Oracle founder and chairman, very briefly held the title of the wealthiest person in the world only to cede it back to Elon Musk in short few days after losing over $100 billion in wealth since his lucky day when the Oracle stock had shot up about 30% in a day.

The same fate can be in the cards for Elon Musk as well, the title holder of the wealthiest person in the world for last few years (since January 2021) surpassing Jeff Bezos of Amazon ever since the stock bubble began inflating in its earnest due to easy stimulus money from COVID triggering the meme stock mania and now the same beast being fed by the AI frenzy in last three years (since November 2022).

The only brief respite was during 2022 when the high-flying NASDAQ stock index lost about 33% of its value and S&P 500 index lost about 20% due to the sudden rise in the interest rates. Back then, it felt like when the market is going to stop falling? It would NOT take a breather in its free fall, albeit slowly. Now, the exact opposite feeling has been there (at least until recently) as to when is it going to stop rising as they are both extremely unhealthy as well as unsustainable. It is like there is no limit to the market up or down when in reality there always is.

The stock market often works like a pendulum and at times it just swings too far in one direction, unfortunately, only to bounce back and normalize in a due time near center.

Eventually, both of these aforementioned wealthiest individuals were destined to cede their respective crowns to the other fellas who are sitting on more solid foundations and not any flimsy footing like they are. Certainly, Larry Ellison has done it so already and, in all likelihood, Elon Musk, may cede the title in a due timeframe as well given this hot air balloon phenomenon with the Tesla (TSLA) stock being its posture child.

Apparently, a little bit of air has started leaking out slowly already from this big inflated balloon due to sheer weight of its own. Hence, it is only a matter of time as to when the air is out completely and/or bubble is burst with one little prick coming from some unexpected source as it often does.

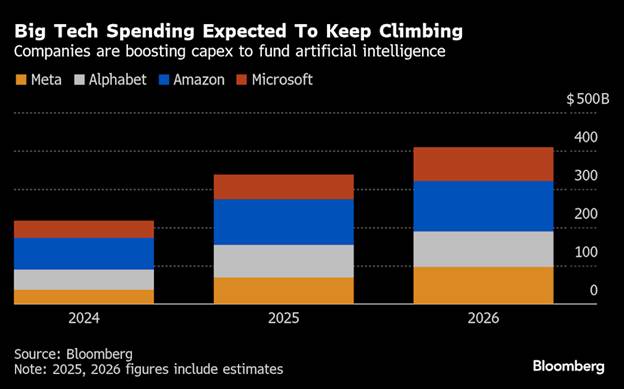

Sheer monopolistic position and pricing power held by the Big Techs have played a major role in raising their company revenue as well as profitability in recent years. Completely unprecedented, the amount of growth in revenue and margins they have experienced in such a short time! In fact, they have truly exploited the inflation related to post COVID recovery time. For their fair share, whether we like it or not, they have put the big bulk of it back in the economy with the frenzied spending on the capex anyways. See the table below.

| Capital Expenditure (CAPEX) | Long Term Debt | ||||||

| Big Tech Company | 2025 TTM ($ mils) | FY 2023 ($ mils) | Percent Change | 2025 TTM ($ mils) | FY 2023 ($ mils) | Percent Change | |

| Amazon (AMZN) | $120,131 | $52,729 | 128% | $142,619 | $142,211 | 0.3% | |

| Google (GOOG) | $77,872 | $32,251 | 141% | $35,763 | $25,713 | 39% | |

| Microsoft (MSFT) | $69,022 | $28,107 | 146% | $103,723 | $70,588 | 47% | |

| Meta (META) | $62,733 | $27,045 | 132% | $48,947 | $35,611 | 37% | |

| Oracle (ORCL) | $27,414 | $8,695 | 215% | $100,010 | $86,420 | 16% | |

| Apple (APPL) | $12,715 | $10,959 | 16% | $89,931 | $106,548 | -16% | |

| Total | $369,887 | $159,786 | 131% | $520,993 | $467,091 | 12% | |

| Source: SI Pro Database | |||||||

The total increase in capital expenditures at the above listed tech companies alone is about $210 billion in 3 short years. These are staggering or eye-popping numbers in such a short time span and explains the rise behind Nvidia revenue and resultant share price and market cap topping at $5 trillion.

This is likely once in a lifetime kind of corporate phenomenon, probably once in hundred years, if not thousand years kind of a flood, rewarding one company or one industry so disproportionately that it is beyond imagination. These capital expenditures are bound to normalize once again and bounce back to more sustainable levels unwinding all this investment frenzy and causing undue pain in the process. That has been the most worrisome part for many.

Much of this capex has gone to Nvidia, AI and cloud related infrastructure. The sole recipient of all this largesse is only one company (Nvidia) and its surrounds. Any way you cut it, only one industry has benefited from it all – AI centered companies.

Just as the heavy investments into laying a fiber when the Internet was in its infancy also contributed greatly to the big boom and eventual bust of the dotcom mania in 2000, the same play is unfolding now in front of our weary eyes due to AI related investments.

Huge amount of unsustainable capex spending there is – therein lies the issue, unfortunately. Just as fast as they have put the money back in the economy with significant and unprecedented rise in capex crowding out other investment areas, they can pull it back just as fast. Remember Meta? They did just that in 2023 by pulling back about 12% of their capex and mass layoffs only to ratchet it back up in 2024 with the advent of AI. Some of these Big Tech companies are notorious for that. The same fate is in the cards again.

Meta episode in 2022 was only the preview. We can only imagine how bad it can get with such a huge amount of capital expenditures now by so many large players in the industry.

Every viable corporation has its operating budget set just like any responsible household. Hence, any variances in it are seriously looked at and evaluated for the needed adjustments.

Big Techs as well as many other businesses across the entire spectrum of economy have had exploitative margins to plump their pockets while the common man suffers in a day-to-day life especially in last couple years due to inflation, be it a price of Netflix subscription or software and cloud subscriptions, not to delve into the electricity and energy price increases in certain areas owing to massive data center capacity increases and related energy consumption.

This market leaders have in fact abused their market leading, if not monopolistic positions and pricing power as a result, which culminated into their really hefty and envious profit margin expansion in last 3 years greatly contributing to the overall inflation scare issue from the broader economy standpoint. As an example, most everyone can relate that something that cost $10 before now costs about $15, debilitating 50% increase in a short few years and clearly the wage gains have not kept up with that. While the stock market continued to soar to the new heights, the common man continued to get pounded and pounded.

Overall, these unsustainable profit margins may not last long and when the time comes to adjust it again, that can inflict even more pain on the economy.

To their credit, these Big Tech companies have solid financials and balance sheet including revenue, operating cashflow and profit margins with the sole exception of Oracle which is racing to the bottom of the barrel, which is truly quite surprising as the ‘debt binge’ has always been Larry Ellison’s favorite thing similar to our not-so-great President DJT as it has served them well thus far for their personal gains. However, going forward, it is an entirely different matter given high interest rates with the specter of going even higher and we really wonder if this will be a straw that may break camel’s back.

Big Techs have used their dominant positions to their advantage and pushed this heavy capex passed on to the individual level in the society indirectly. Once, the management sits down to do serious return on investment (ROI) calculations, they are bound to be disappointed and eventually pull back to the chagrin of a common man who will be affected even more.

Once the Big Techs put the capex in the reverse gear, we can only imagine the detrimental effects arising out it and spilling over the broader economy just as it has done so on the positive side at the moment.

In fact, all this Big Techs have already started seeing reduced free cashflow margins in the most recent 12 months from their 3-year average. Hence, it will not be long before they realize it and clamor to readjust.

Interestingly, Apple has stayed out of this mad rat race and profitless endeavor to the bottom and not embarked on this dangerous journey of heavy and unsustainable capital expenditures. However, it’s stock is another story. It still remains prohibitively expensive at more than triple the valuation it commanded even when it was in a decent growth mode during 2010s.

In other words, Apple experienced an explosive growth in valuation expansion itself as its price to earnings ratio expanded significantly from low 10s to about 40. No wonder, Warren Buffett has unloaded 75% of his stake in Apple already for Berkshire Hathaway and it should not be surprising if he continues to trim it even further in upcoming quarters. It also means that Apple can lose about two-third of its value and still be in line with its historical valuation level.

Bloomberg also did a similar analysis on the capital expenditures as shown below which shows that the capex doubled in about two years:

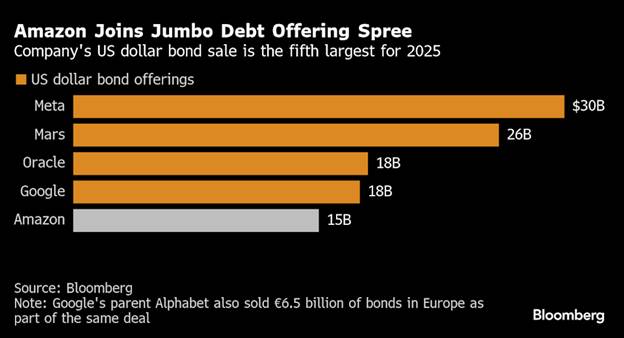

That was all capex! When it comes to the debt binging, which is a whole another story, there are two notable exceptions: Apple and Amazon in comparison with other Big Techs. See the debt figures mentioned in the table above and chart below.

In summary, Apple is the only one that did not embark on a capex as well as debt spree whereas Amazon simply did not jump on the debt spree, though, for its part, it did feast on the capex front as it generally has to do so owing to its market leading position for cloud via Amazon Web Services (AWS). Rise in capex over the last 3 years of over $200 billion or 131% growth just from these leading big techs is a sign of excess, desperation or ‘Fear of Missing Out’ (FOMO), not wise and well calculated, well-planned investments ahead of time. So is the rise in Nvidia’s annual revenue, from $27 billion to well over $200 billion run rate in three years, approaching 10 times. That is not coincidental…and without major adverse effects in future.

Leave a reply to Big Bear Case Study & The Biggest Posture Child of Current AI Mania: Tesla (TSLA) – Street Analysis Cancel reply