In a technology parlance, we “enabled” the crisis mode for U.S. on Jan 15, 2026 via this post: Crisis Mode Enabled for USA: Ticking Time Bomb (Warning # 1) – Requires Defense & Offense Investment Strategy.

Soon after or just within two weeks after posting the above, we had a subsequent post issuing a warning # 2 on Jan 30, 2026 via the following post: New Sheriff in Town of Financial Markets: Crisis Mode for USA – Warning # 2 (Much Sooner than Expected).

Sure enough, one of the greatest investors, Ray Dalio, who founded one of the largest hedge funds, Bridgewater Associates about 50 years ago in 1975, just sounded a huge alarm on February 14, 2026 via this post It’s Official: The World Order Has Broken Down

on LinkedIn and via the same article header here on platform X (formerly Twitter). Most importantly, Dalio is known as a brutally honest leader and one of the most revered fund managers.

It is about time! I had been wondering for quite some time as to why is it taking this long for Ray Dalio to issue a giant warning with the big red flashing signal. I had been rooting for him to announce it officially and he finally did and I am really glad that he did. I simply was not sure what he may have been waiting for after seeing what we have witnessed in this country in recent times.

It takes a lot of guts to do so and of course, he showed that. Now, we can only wish that more and more business and political leaders do the same to salvage our country for whatever there is left of and have a new beginning, which also may take a very long time as we have no other option to cut through the next 3 years under the “savage evil president” and his “bootlicking sycophant goon gang” enabled and aided by “ignorant masses”.

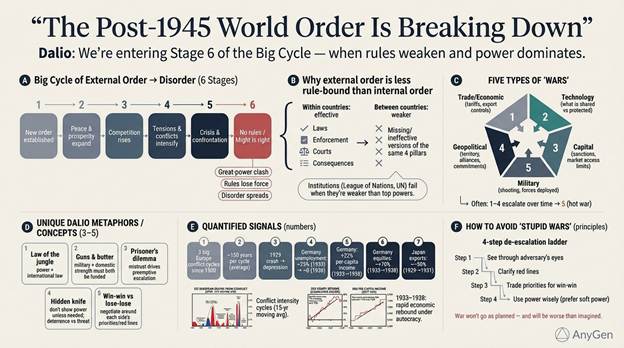

Ray Dalio had been warning of this world order breakdown in formation via his very detailed explanations of various stages and now we have officially entered the last phase according to his analysis. See the below graphic.

What does this all mean? Well, it is scary times for sure and for the unprepared or unfortunate ones, it may be hard to envision all sorts of scenarios that may materialize. The consequences can be dire if we are not prepared well.

All hell is beginning to break lose in the crypto world backed by easy money and the barrage of money printing of last 15 years and especially last five. Software stocks have been pummeled. A good example is iShares Expanded Tech-Software Sector ETF (IGV) that is down 22% year-to-date and not much above from the 5-year trendline.

What is next? The movie has only begun and we are hardly in a second or third inning of the complete chaos or destruction, rather unravel in the financial markets. It is about time to get real. The solution lies in a fully-hedge portfolio fortified by sophisticated diversification including ‘real’, i.e. physical asset classes such as real estate, commodities and yellow metal that is gold.

Leave a comment