Happy New Year Once Again! Here is to the best and the brightest for 2026! As we began this year with much gusto, we can first reflect on the year that just passed – 2025 and see that it was more of the same from the overall markets’ perspective.

The years 2023, 2024 and 2025 were made of the exact same template – more and more gravitational pull towards the ‘risk on’ assets, more you pile up on them, more money you can make. It was an easy choice – like predicting a weather.

Today’s weather is same as yesterday and tomorrow’s weather will be same as today – until something changes. Basically, that is the doctrine most folks tend to follow and it works out alright for the most part as well.

While we shall not believe fiercely in making predictions or forecasts, we must make ‘educated guesses’ about the future based on more informed analysis, deploy prudent ‘risk management’ techniques and prepare for the worst.

After having a brutal 2022 for both stocks and bonds, the year of realization or even a major point of inflection when it comes to the interest rates, 2023 deserved a well needed bounce…however, after that, things got out of control for the 3 subsequent years, aided by AI invention, and they still are. However, it does not mean that it will stay that way for ever. It never does. That is how the life and world works.

Change is the only constant in life. So, we must brace for the change, else, we are destined to fall or even fail. The following proverb or the quote by a French critic, Jean-Baptiste Alphonse Karr, is quite apt for the occasion: “The more things change, the more they stay the same”. It is quite a contrasting, if not dizzying, statement. Isn’t it? It indeed is. However, that is a reality as everything on the surface changes, however, at the very bottom, the substratum remains all the same. That is the ‘Reality’. That is the ‘Truth’.

Bond holders woke up from their long slumber in 2022 and now gold vigilantes are back in full force. There ain’t going to be a free lunch anymore, not for long at least. We must pay the piper owing to the profligacy of decades in U.S., not just the years, aided or even ignited by lower and lower interest rates – akin to getting high with more and more drugs.

Gold beat the stocks by a whopping margin of close to 50% out-performance and even more eye-popping was the beat to Bitcoin by 70% in 2025. The raw numbers are as follows for each of the 3 popular asset classes, that is if we were to even count Bitcoin as an asset class, which is really a ‘gambling class’, not a true asset class, a ‘rat poison squared’ as Warren Buffett and Charlie Munger put it:

S&P 500: 16% | Gold: 65% | Bitcoin: -6%

S&P 500 return above is excluding the puny and ever-decreasing dividend yield of 1.27% last year on the backs of ever-expanding valuation multiple. This is all while 10 Year treasury started the year closer to 5% or 4.57% to be more precise and spiked to as high as 4.81% in mid-January of last year. It ended the year closer to 4% and again to be more precise, it closed the year at 4.16%.

Similarly, the U.S. dollar continued to weaken in reference to other major currencies as well with a meaningful degree in 2025 – something newer of a phenomenon, though, not surprising at all. See a nice capture or summary below by Ray Dalio, one of the greatest and biggest hedge fund manager, in his LinkedIn post on January 5.

“Regarding 1) what happened to the value of money: the dollar fell by 0.3% against the yen, 4% against the renminbi, 12% against the euro, 13% against the Swiss franc, and 39% against gold (which is the second largest reserve currency and the only major non-fiat currency). So, all fiat currencies fell, and the biggest story and the biggest market moves of the year were the result of the weakest fiat currencies falling the most, while the strongest/hardest currencies strengthened the most. The best major investment of the year was long gold (returning 65% in dollar terms), which outperformed the S&P index (which returned 18% in dollars) by 47%. Or, said differently, the S&P fell by 28% in gold-money terms.”

The bottom line is that gold is the only real money, whereas every other currency is called a fiat decreed by an authority or rather just paper money subject to significant erosion by the sheer power of inflation. Gold is real money for not only decades or centuries though for millenniums. Everything else loses value, though, gold does not. It is the best source of value preservation and inflation hedge. Gold has its limitations as it does not create value like stocks, though, it does not erode the value like cash or currency.

Looking forward to 2026, the ‘gold revolt and dollar-debasement’ trends can reasonably be expected to continue. We covered that about three months ago with the following post:

Ominous Signs & Gold Revolt – A Dollar Debasement Trade. However, it does spell trouble for stocks as soon the reality hits the ground which we are getting closer and closer by the day.

The usual suspects for the major downfalls are high flying AI ‘bubblish’ stocks such as from Nvidia ($NVDA), Tesla ($TSLA), Oracle ($ORCL), Palantir ($PLTR) to all of The Magnificent Seven stocks that are also reframed as AI hyperscalers now or massive tech companies in simple words that continue to feast on fat profit margins. The question is for how long? Oracle has already succumbed to the reality for the most part as covered in an earlier post and still may have much more downside. Others will have to soon follow when this bubble pops. A good reminder will be the ‘Truth’ outlined earlier in the proverb.

Another helpful indication that we could be closer to the terminal peak, rather than the bottom of a new bull market as many eternal bulls profess, is high-flying ‘memory’ stocks representing sheer commodity business from Micron ($MU) to Sandisk ($SNDK), a top performer in S&P 500 in 2025, to Seagate ($STX) to Western Digital ($WDC) as many of them went up manyfold – yes, manyfold last year.

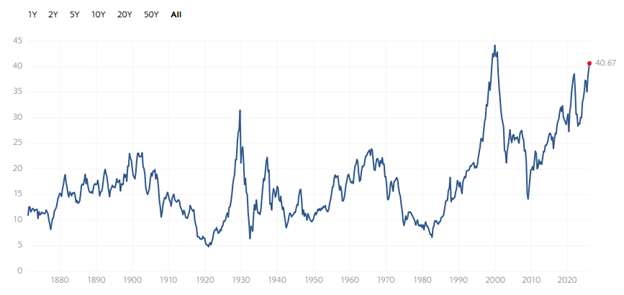

Picture is worth the thousand words similar to references in earlier posts. We need not explain it more and one can make a judgement at his or her own peril. The worrisome part is that now we have crossed the dangerous number of 40. However, where is the limit – does anyone know? Unfortunately, not. We crossed 20 first then 30 and now 40.

Source: Shiller PE (Multipl.com)

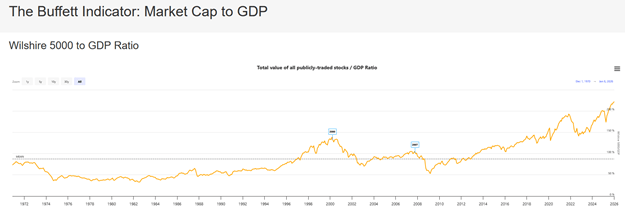

Similarly, here is the graph for the Buffett indicator as it is known to reflect the overall market cap to GDP ratio, which also is in a pretty dangerous territory of over 200% (220% to be more precise), the highest ever by far and even beyond the dotcom mania. Enough of the exuberance! Warren Buffett once remarked to the effect that ratio of 1 or 100% is a nice place of equilibrium from which we have swung too far to the right.

Source: LongTermTrends.com

Law of gravity always persist – a universal law. The ball can be thrown in the air for only so long. The mass insanity can only last for so long, so can the hyper-ness or depression of the masses.

In such a dire situation, how do we find a tricky balance? Well, first we need to be defensive and then position ourselves by taking a select offensive positions – the only way to get thru these treacherous times. The U.S. is certainly sitting at the edge of the cliff and one push, just one push, can easily slide us into the abyss, the bottomless pit, especially with the current presidential administration which is nothing short of evil and incompetence, though, fully capable of taking the country to a complete ruin.

The only competence this administration has is in its evilness enabled by sycophant bootlickers and supported by ignorance of certain segments of populace, again a rarity like the above two graphs that we can only wish that it disappears soon enough for the sanity of the rest of the country or heck, even the world.

A good example is an announcement by the President today such as raising our defense budget by a whopping 50% – from a trillion dollars to $1.5 trillion with the money we do not have (or rather can easily create any longer) and increasing annual deficit by 25% – from $2 trillion to $2.5 trillion dollars if we were to even think that this ‘whim’ were to turn into a reality similar to a whim of paying a $2,000 tariff ‘dividend’ check to everyone with the money again that our country does not have and no one earned.

Now, do we see a connection any better with the fiat currency or rather a fake currency at its worst as it has happened to certain countries much to the chagrin of the proletariat there? It brings nothing but misery and poverty to the masses. Though, again, does the ruling class care? Probably, not. That is what the history has shown time and again. However, how many of us care to read the history, let alone learn from it? Countless examples have been there in the past as well as present.

There can be ‘N’ number of possibilities to push us off the cliff into abyss. Our job is to protect ourselves as best as we can from such possibilities. At least from the ones we can foresee as a possibility.

Overall, there is a high probability of the markets getting punished in some form or fashion by the bond vigilantes and/or gold revolutionaries if not aided by any other external factors which is often the case.

Hence, here are the few key takeaways for the year:

- Increase the cash allocation level to have more dry powder on hand to prepare for the tough times and jump in to the market aggressively if and when the markets were to turn ugly.

- Lighten up an overall exposure to the two main asset classes: stocks and bonds

- Lighten up, if not eliminate entirely, especially on the expensive or frothy stocks.

- Similarly, lighten up exposure to the long-term debt instruments.

- Essentially, stop playing with the fire.

- Establish or increase the exposure to defensive and value stocks that can withstand the jolt better (expected or unexpected)

- Establish or increase the exposure to ‘real money’ that is gold, even after this explosive move upward last year, in the form of diversification into a commodity asset class.

- Be a more disciplined investor in light of all the craziness that is going on in the world, especially in our own backyard. Cynical? Perhaps, though, it is not that far from the reality, unfortunately. Wars rage on all over the world and as if external wars were not enough, we have an internal one now within the U.S. not much short of a civil war

As for the gold, we just need to remember that it is ‘money’, not an ‘investment’ especially owing to the ‘orgy’ of spending by the U.S. government. Unlike many folks here in the US, I am all for the government and all in for the sacred temple of democracy, however, currently, we cannot have much trust any longer in this government doing the right thing especially by the current administration. To top it all off, the Federal Reserve (Fed) is losing its independence, a separate topic that we can cover in more details at some point.

In essence, the bond and gold vigilantes are back in full force and/or watching the show with a very tight leash!

As we begin the new year, a good reminiscence shall be the below pair of the verses in Shrimad Bhagavad Gita, a diamond of all Hindu scriptures.

ये मे मतमिदं नित्यमनुतिष्ठन्ति मानवा: |

श्रद्धावन्तोऽनसूयन्तो मुच्यन्ते तेऽपि कर्मभि: || 3.31||

ये त्वेतदभ्यसूयन्तो नानुतिष्ठन्ति मे मतम् |

सर्वज्ञानविमूढांस्तान्विद्धि नष्टानचेतस: || 3.32||

BG 3.31: Those who abide by these teachings of Mine, with profound faith and free from envy, are released from the bondage of karma.

BG 3.32: But those who find faults with My teachings, being bereft of knowledge and devoid of discrimination, they disregard these principles and bring about their own ruin.

Source: JKYog Gita

Leave a comment