What is the source of the current AI (artificial intelligence) stock mania? By far, majority of the conscious investors can answer that it is Nvidia (NVDA) and/or OpenAI, a private enterprise, and broadly speaking it is a true answer. However, this much also can be said that the main engine behind this explosive growth of AI and resultant stock mania is ChatGPT product unveiled by OpenAI in November 2022. OpenAI is the brain behind it and Nvidia is the brawn enlivening the AI experience.

In our previous post, we delved a little bit on Tesla (TSLA), the biggest poster child of AI hype and that remains true as it reached giddying heights. However, the source behind it all remains Nvidia. About three months ago, we have written about 4 pillars of the AI stock mania as well here.

If we were to use an analogy of the human anatomy, it is fair to say that Nvidia is the body that carried all the activities with the engine or heart or even brain for that matter that is OpenAI powering all of the activities of this AI human body. Human body is so intricate, the most wonderful of all creations in this world and so is the human brain or heart that keeps us all truly alive.

Alternatively, OpenAI and Nvidia can also be equated as parents of AI mania: OpenAI being a mother and Nvidia being a seed giving father to AI mania child or shall we say a manic child?

Diving straight into the topic of relevance and the timing could not have been better. Just as we were to focus this week’s note on Nvidia and pertinent details, the poster boy of AI age, Cisco Systems (CSCO), the dot-com darling of late 90s and the center of all attention then like Nvidia today, just yesterday crossed it’s all time high of March 2000, which is over 25 years later. Yes, I repeat, Cisco recaptured it’s all time high after over 25 years and closed at $80.25 surpassing its previous all-time high of $80.06 on March 27, 2000. That is an eternity in the financial markets and our hat’s off to the investor, if such a brave soul even exists, who purchased it at the peak and held on to the stock for 25 long years, only to get a zero percent return. See below.

Cisco Systems was to Internet or dot-com boom that is Nvidia today to AI boom. The dot-com boom was known for the buildout of infrastructure or ‘plumbing’ as it was known then for building the vast network named as the ‘World Wide Web (www)’. Cisco was known as the ‘plumber’ and major telecommunications companies were laying the fiber that is so ubiquitous today in our daily lives. The high-speed Internet was a dream then that we take it for granted today.

Source: Yahoo Finance

We covered Nvidia hitting a $5 trillion market cap just about 6 weeks ago on October 30 in the post here. Since then, it has not broached that all time high yet again and neither do we expect it to do so anytime in a near future that these weary eyes can see. In fact, Nvidia is down by about 13% already at $184 from the all time high of $212.

We can never say never as this AI mania can go on even further and attain even more dizzying heights. However, we can certainly see that the cracks have started to appear now in this AI mania and Oracle (ORCL) has been the very first casualty of the big tech companies with being about 40 percent down in recent days from its all-time high on September 10. That is when Oracle founder Larry Ellison was also temporarily awarded the title of the wealthiest person in this world as covered in the post here.

Oracle reported its quarterly earnings yesterday after the market close and it does not seem to be too inspiring and as a result, the stock is down by about 15% today. We shall see if this helps already fidgety investors find more cracks in the AI thesis or soothe any concerns.

AI is real, though, AI boom is unreal just as the Internet was real and the boom was unreal at the time. Our world has seen truly amazing things with the advent of Internet and its commercialization starting with the Netscape web browser and its IPO in August of 1995. It sparked close to 5 years unrelenting boom in the Internet buildout only to be burst badly with many companies loosing over 80 or even 90 percent of its value, if not 99 percent in many cases.

Very few companies rose back from the ashes such as Amazon (AMZN) from such devastating losses and made the history. Further, Cisco is the prime example as the darling of the time took over 25 years to reattain the same stock price.

Since then, amazing things have happened in the Internet space and it is hard to envision a life without Internet now just as it is without other life essentials such as air, water and even electricity. Mobile is the crowning achievement of a mankind on top of the Internet which makes it so essential for most everyone on this earth.

Similarly, we can also envision how AI can transform our world even further in the next 5, 10 and 25 years, much of it will be beyond our imagination as we could not have imagined the world today back in 2000.

This also reminds us of the Nikkei 225 index of Japan that took well over 34 years, I repeat 34 years, to cross its previous high of close to 40,000 in December 1989 arising out of its economic bubble and finally surpass the previous high in February 2024. For it’s fair share in the market madness, Japan saw the euphoria in both the stock market and real estate market during the 1980’s. Does that sound familiar as to what we see back home here? It sure sends a chill to our spine.

Meta, the Facebook parent (META) is significantly reducing its commitment to Metaverse, the virtual reality and 3D play, by cutting its budget by 30% after burning through $70 billion just in last few years. Yes, the big boys have the big numbers. Or shall we say that Meta is quietly pulling a plug on its biggest gamble or rather a foolish fantasy of having us all live in the virtual world (fantasy world) and fake economy and not a real world with the real economy?

Bigger the man, bigger the whims and bigger the evil-doing tendencies at times as the history shows time and again for the societies to slide into oblivion from all the hard work by prior generations. This is certainly not referenced to ‘Zuck’ as many would love to, though. However, many of our political as well as business leaders can certainly fit into this category the roster is replete with multitudes of names. The ills of social media only amplify them all.

Back to Nvidia, here are some red flags that we see in the current business situation:

- Revenue Sustainability: Chips and software businesses are one of best in the world in terms of their stability as well as profitability barring commodity business of memory chips which is more known for its frequent booms and busts. However, the same, i.e. sustainability, cannot be said for Nvidia’s future business, even though, it is not a commodity business, primarily due to major spike or panic driven boom in AI capital expenditures (Capex).

- Customer Concentration: Top 2 customers (undisclosed names) represent about 39% of Nvidia revenue in the most recent quarter, up from 25% in a prior year. Similarly, the top 6 customers represent about 85% of the revenue. These are staggering numbers for certain, if not outright worrying numbers. To make it worse, these big techs are not exactly known for their steady hands and rational behavior as they accumulate more and more power in this highly interconnected as well as concentrated digital world. Hence, in the end, Nvidia sales can come down just as fast as it went up, a real irony as that is not what we would normally expect a solid company to experience. Normally, we do not see the big reversals in big businesses unlike a real high probability here. Emerging competition from other chip makers such as AMD or even Amazon and China will only add more flavor to the story.

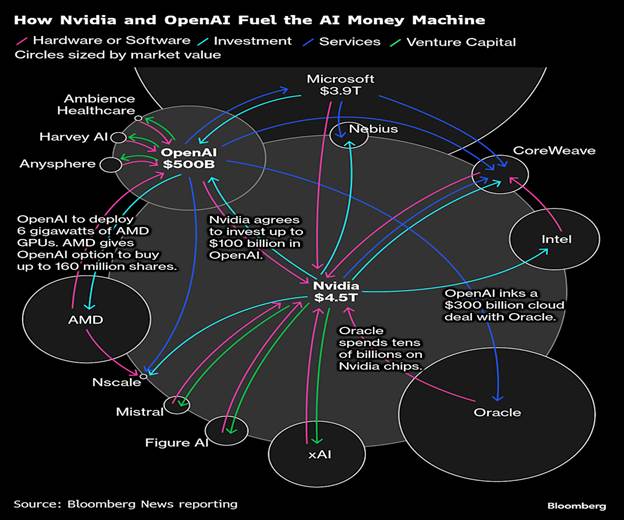

- Circular Investments: Wall Street investors have become more aware, as of late, if not outright questioning or suspecting of the circular nature of AI investments and its potentially high detrimental effects in future. See below graphic representation of the AI ecosystem powered by the major tech players.

- Alleged Accounting Gimmicks: Some venturesome folks have accused Nvidia and other companies of accounting gimmicks as well as to how the revenue is recognized, supplier taking a stake in customer and financing the purchase, etc. This echoes the worst of the memories of the dot-com mania culminating into Enron scandal in 2001 wiping out many retirees’ assets and leaving a permanent mark on investors’ minds.

- Energy Implications: The data center boom and related surge in the energy needs only compound the fragility of the situation, not to mention the potentially devastating effects of the energy needs arising out of crypto mania.

The bottom line is that Nvidia is a dead or rather dud investment as far as the eyes can see. It is destined to be another Cisco from our vantage point and the only unknown is how long one may have to wait to recoup his / her investment if bought at or near peak. Can it be 5, 10, 25 years or even never? For context, Nvidia’s $5 trillion-dollar peak valuation barely a few weeks ago is greater than the well growing economy of India, the entire country hosting the largest population, about 1.5 billion, on this earth.

Managements of the big tech companies are notorious or even outright irresponsible socially, if not completely unethical at times, for their desperate, panicked or even wicked behavior, quite the opposite of well-reasoned and rational investments, hiring and firing decisions ruining the early career starts of many young aspirants as well as mid-aged professionals. The worst of all was the Meta management that ignited a similar hiring and firing wave in 2020-2022 in light of the COVID related remote work and major investments into metaverse. So is happening now again with AI and thankfully appears to be in its one of the final phases as opposed to the beginning phases if we are to interpret these cracks properly. Thank God!!

During its heyday from the valuation perspective, Cisco had a decent revenue growth as it grew from $12 to 19 billion in sales in year 2000, about 55% increase from the prior year. Now, it is at the run rate of about $60 billion in revenue or about 3 times as much after about 25 years.

Just as Cisco, the poster boy of the Internet boom era, topped its dot-com record close after 25 years, we need to get ready for the repeat for the AI capex boom era with Nvidia being a center of all attention now. While a lot has been accomplished on the tech front in last 25 years and it will happen again in the next 25 years, though, it cannot ever, ever, negate the effects or dire consequences of bad investments. Bad investments only have to be written off.

Current Nvidia sales at over $200 billion run rate are over 10 times what was for Cisco then and so is the overvaluation scale of Nvidia, company with close to $5 trillion market cap. Hence, the effects can be 10 times as bad as well. In a short few years, can Nvidia be selling at one tenth of its current valuation today – down from $5 trillion to about $500 billion, which is still very, very respectable amount? It is entirely plausible. Let us not hold our breath for the better outcome.

A mere 3 years ago, Nvidia sales were close to one tenth of current sales anyways!

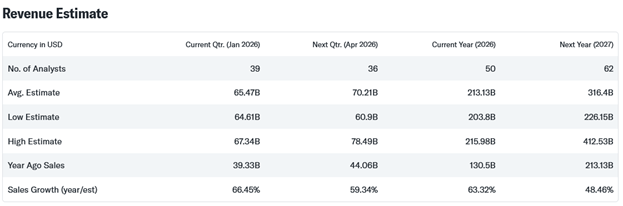

For more analytical types, here is the snapshot of revenue projections for Nvidia by Wall Street Analysts that almost always proceed as herd. See below. From where I sit, just as fast as Nvidia grew and, in the magnitude, it can come down as fast and as much as well.

Source: Yahoo Finance

Future commitments and so-called contracts by big data center operators in this circular AI economy is one thing whereas the actual revenue flow is whole another, let alone the profitability as was the factor for the dot-com bubble burst. To exacerbate the issues, the actual revenues may come crashing down as well at the first sign of real trouble. Initial cracks seem to be manifesting already. A good example is that the credit default swap (CDS) pricing for potential Oracle bond defaults have spiked up materially, the highest since the great financial crisis (GFC) of 2008-2009.

Cherry on the top is our beloved U.S. Government’s cut of as high as 25 percent of AI chip sales by Nvidia to China. Talk about the bizarreness of the current geopolitical situation to further muddy the business waters, entirely different topic. There goes U.S. competitiveness in the world and tough talk on China out the window and what is in is the double standards, often the case for our foreign policy!

Leave a comment