Who is the biggest poster child of the current AI stock mania? One would think in the big bear community that it is Nvidia (NVDA) hovering around $183 per share and $4.5 trillion market cap down from $5 trillion little over a month ago. Nay…it is Tesla (TSLA) with the price tag of $455 per share commending the market cap of about $1.5 trillion.

Nvidia for its fair share is very expensive without a doubt, however, it still represents the solid underlying business fundamentals and related numbers. Now, whether that business model and related valuation is sustainable or not and where it will stand a couple years from now is an entirely different topic that is worth discussing and we can certainly address separately sometime in future.

However, for now, focusing just on a true poster child, and the biggest one at that, of the current AI stock mania and ever-expanding stock valuations for the broader market as a whole, we can have a bit more detailed look at Tesla’s business or rather “pie-in-the-sky”, if not outright foolish and outlandish announcements, not the actual business or dollars-and-cents that warrants such a high valuation – all built primarily on two following ‘concept’ products: Robots and Robotaxis known as cybercab.

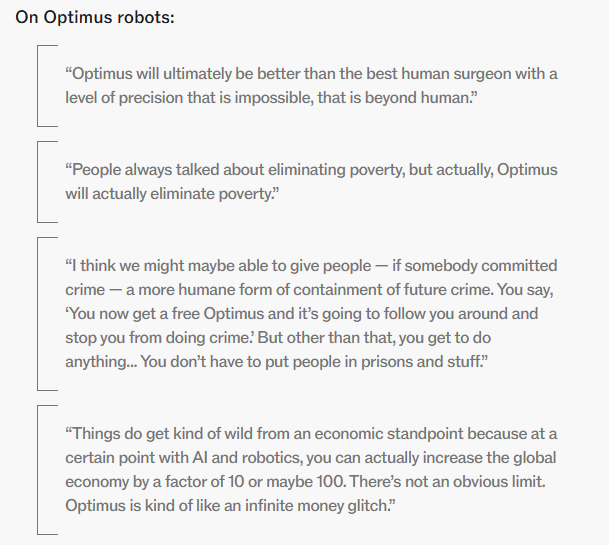

True to his nature, here are some of the wild claims made by Elon Musk, Tesla CEO, during the most recent shareholders meeting in November, the wildest of which are as follows:

- Optimus Robots can eliminate the poverty

- Robots can increase the global economic output by 10 or even 100 times

No wonder, Tesla shareholders were so keen on approving a “trillion-dollar” pay package for the fellow with 75% approval, who already is the richest person on this earth, roughly half a trillionaire, all probably because of the ‘enticement’ to eliminate the poverty in this world! We can make the richest person even richer and eliminate all of the poverty!

Then again, Tesla shareholders were not so dumb as they also signed up for dangling another carrot which can increase Elon Musk’s net worth by a ‘phony’ trillion dollars. If the Tesla shares were to be repriced at its true intrinsic value, which it may well in not-so-distant future, given the direction we are heading towards, the effective package value may literally be worthless instead of a trillion-dollar face value. At best, it may be worth $50 or $100 billion even if some of the claims were to turn into a reality in the due time and may enhance his net worth by 10% or 20% at best.

Source: Sherwood Media (Robinhood Markets)

No doubt, Elon Musk deserves a credit, a lots of it, for creating an entire electric vehicle (EV) industry single-handedly that no other automaker ever did before being mired in a ‘status-quo’ that often this world is. Hence, hat is off to him!! However, creating an EV industry was not a stretch or at least not anywhere near what this is for the other two products or industries for which the Tesla shareholders have become completely blindsided, not to mention the ample flow of ‘easy money’ in recent years from the Federal Reserve.

Tesla sales are literally flat for nearly 3 years in 2023, 2024 and 2025 all a bit under $100 billion per year from nearly zero for the industry several years ago. Tesla has maintained about 6% free cashflow margin for the last 3 years meaning it generates approximately $6 billion in a free cashflow per year at literally flat revenue tad below $100 billion. Applying a very generous multiple of 50 times free cashflow, Tesla valuation amounts to $300 billion and brings it at par with Toyota, the largest automaker in the world, that is at $260 billion market cap.

Sales being routinely down 50% year over year in Europe during 2025 is a ‘cherry on the top’ primarily owing to Elon Musk’s extreme right leanings.

What this means is that there is a valuation gap of about at least 80% or $1.2 trillion by deducting $300 market cap it may deserve at best from the current market cap of about $1.5 trillion – all of this is owed to the ‘pie-in-the-sky’ business model. In other words, Tesla can loose about 80% of its share price and still be considered pretty respectable market cap.

Stocks appear to be making a peak as covered in earlier post(s) as proven already in case of Oracle, one of the 4 pillars of the house of cards, down over 40% from its peak.

Tread the waters carefully!

Leave a comment